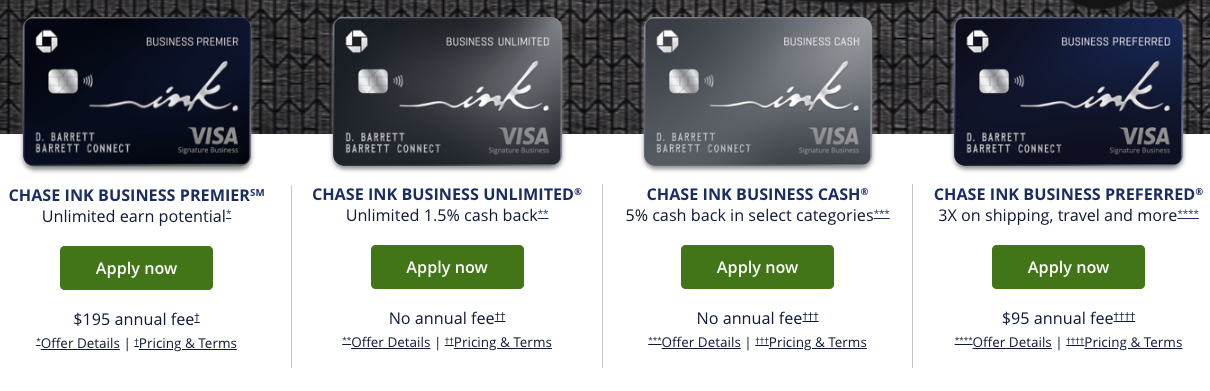

Chase’s business credit cards offer varied benefits suitable for different business needs.

Here we explore the following Chase business credit cards:

- Chase Ink Business Unlimited®

- Chase Ink Business Premier℠

- Chase Ink Business Preferred®

- Chase Ink Business Cash℠

Chase Ink Business Unlimited

Introductory Offers and Earnings

The Unlimited card offers a $750 bonus after spending $6,000 in the first three months. It provides an unlimited 1.5% cash back on every purchase.

Fees and Interest Rates

No annual fee makes the Unlimited card an attractive option. It includes a 3% foreign transaction fee and offers 0% APR on purchases for 12 months, after which a variable APR of 18.49% to 24.49% applies.

Cash Back Usage

Cash back can be redeemed at any point and remains valid indefinitely, provided the account is kept open.

Chase Ink Business Premier

New Member Bonuses and Cash Back

The Premier card tempts with a $1,000 cash back bonus after a $10,000 spend within the first three months. It also rewards purchases with a steady 2.5% cash back on transactions of $5,000 or more and an unlimited 2% cash back on all other business purchases.

Costs and Charges

An annual fee of $195 applies, but there are no fees on foreign transactions. Interest rates vary between 19.49% and 27.49%.

Redemption and Transfer Options

Cash back rewards are versatile, redeemable anytime and do not expire as long as the account is active. Points earned, however, cannot be moved to other Chase cards or transferred to travel partners.

Chase Ink Business Preferred

Sign-Up Incentives and Points

The Preferred offers 100,000 bonus points post a $15,000 expenditure within the first three months. It grants 3 points per dollar on the first $150,000 spent in select categories, and an unlimited point per dollar on all other purchases.

Annual Fee and Foreign Transactions

With a $95 annual fee and no foreign transaction fees, it positions itself as a mid-range option. The APR is variable, between 21.24% and 26.24%.

Point Redemption

Points increase in value by 25% when redeemed for travel via Chase Ultimate Rewards, providing significant potential value.

Chase Ink Business Cash

Welcome Bonus and Reward Structure

Like the Unlimited, the Cash card has a $750 bonus cash back offer for the same spend and time constraints. It features 5% cash back on the first $25,000 spent in specific business categories, including office supplies and communication services, 2% back at gas stations and restaurants, and an unlimited 1% on all other purchases.

Annual Fees and Additional Costs

This card is also free of an annual fee, charges a 3% fee on foreign transactions, and carries the same 0% introductory APR for 12 months.

Rewards Lifespan

The rewards don’t expire, ensuring flexibility and value retention for users.

Protection for Your Business

All four cards come with a suite of protection benefits, offering peace of mind and security in various business activities and purchases.

FAQs – Chase Business Cards – Unlimited vs. Premier vs. Preferred vs. Cash

What are the annual fees for Chase Ink Business Premier, Unlimited, Cash, and Preferred cards?

- Chase Ink Business Premier: $195

- Chase Ink Business Unlimited: $0

- Chase Ink Business Cash: $0

- Chase Ink Business Preferred: $95

How do the cash back rates compare among the Chase business cards?

- Chase Ink Business Premier: 2.5% cash back on purchases of $5,000 or more; 2% on all other purchases

- Chase Ink Business Unlimited: 1.5% cash back on all purchases

- Chase Ink Business Cash: 5% cash back in select categories; 2% at gas stations and restaurants; 1% on all other purchases

- Chase Ink Business Preferred: Not applicable for cash back but earns points

Are there any foreign transaction fees on Chase business cards?

- Chase Ink Business Premier: No foreign transaction fees

- Chase Ink Business Unlimited: 3% foreign transaction fee

- Chase Ink Business Cash: 3% foreign transaction fee

- Chase Ink Business Preferred: No foreign transaction fees

What are the sign-up bonuses for each Chase business card?

- Chase Ink Business Premier: $1,000 bonus cash back after spending $10,000 in the first 3 months

- Chase Ink Business Unlimited: $750 bonus cash back after spending $6,000 in the first 3 months

- Chase Ink Business Cash: $750 bonus cash back after spending $6,000 in the first 3 months

- Chase Ink Business Preferred: 100,000 bonus points after spending $15,000 in the first 3 months

Can you transfer points from the Chase business cards to other loyalty programs?

- Chase Ink Business Premier: Points cannot be transferred to other Chase cards or Chase Travel Partners

- Chase Ink Business Preferred: Points can be transferred to a variety of airline and hotel loyalty programs

Chase Ink Business Unlimited and Cash cards do not earn points but cash back, which cannot be transferred to loyalty programs.

What is the APR after the introductory period for each card?

- Chase Ink Business Premier: Variable APR of 19.49% – 27.49%

- Chase Ink Business Unlimited: Variable APR of 18.49% – 24.49% after 12 months of 0% introductory APR

- Chase Ink Business Cash: Variable APR of 18.49% – 24.49% after 12 months of 0% introductory APR

- Chase Ink Business Preferred: Variable APR of 21.24% – 26.24%

Which Chase business card offers the best rewards for office supply purchases?

- Chase Ink Business Cash: Offers the best rewards for office supply purchases with 5% cash back on the first $25,000 spent in combined purchases each account anniversary year.

How does the Chase Ink Business Preferred card enhance the value of points for travel?

- Chase Ink Business Preferred: Points are worth 25% more when redeemed for travel through Chase Ultimate Rewards, e.g., 100,000 points are worth $1,250 towards travel.

What kind of protection benefits do Chase business cards provide?

All Chase business cards come with protection benefits including travel and purchase protection, offering peace of mind for business-related expenses.

Do the rewards on Chase business cards ever expire?

No, rewards on all Chase business cards do not expire as long as the account is open and in good standing.

Conclusion

Each card offers distinct advantages, whether it be higher cash back rates, bonus points, or fee waivers.

Businesses should weigh these against their spending habits and financial strategies to choose the most beneficial card.