When it comes to investing or saving $100,000, understanding the monthly interest you can earn is crucial.

The returns and interest earned will depend on various factors, such as the type of investment or savings vehicle you choose and the interest rate calculations involved.

Let’s explore how to calculate your monthly interest, the difference between compound and simple interest, and how to maximize your investment returns.

Key Takeaways – Monthly Interest on $100,000

- Calculating monthly interest on $100,000 is essential for understanding your investment potential.

- Compound interest allows your investment to grow exponentially over time.

- Simple interest provides a fixed interest rate on the principal amount.

- Understanding the monthly interest rate and how it affects your investment returns is crucial.

- Consider diversifying your investment portfolio to maximize returns and minimize risks.

Overview – Monthly Interest on $100,000

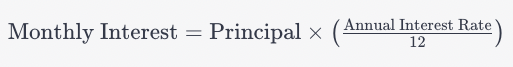

Here’s how you can calculate the monthly interest:

Where:

- Principal = $100,000

- Annual Interest Rate = Various rates

Let’s calculate the monthly interest on $100,000 for a few different annual interest rates:

1. 1% Annual Interest Rate = $83.33

2. 2% Annual Interest Rate = $166.67

3. 3% Annual Interest Rate = $250.00

4. 4% Annual Interest Rate = $333.33

5. 5% Annual Interest Rate = $416.67

… and so on.

You can apply the formula to other interest rates to get the respective monthly interest amounts.

Note that these calculations assume simple interest rather than compound interest.

If your interest is compounded monthly, the calculations would be different.

Investment Options for $100,000

An investor with $100,000 has a variety of options when it comes to interest-earning investments.

These options include stocks, real estate, commodities, collectibles, money market accounts, money market funds, certificates of deposit, Treasury securities, Series I savings bonds, corporate bonds, and municipal bonds. Each investment option has its own level of risk, potential return, and liquidity.

Stocks offer the potential for high returns but also come with a higher level of risk.

Real estate investments can provide both rental income and potential appreciation, but they require careful market analysis and management.

Commodities and collectibles can offer diversification and potential appreciation, but their value can be volatile.

For those seeking lower risk options, interest-earning investments such as money market accounts, money market funds, certificates of deposit, Treasury securities, Series I savings bonds, corporate bonds, and municipal bonds are worth considering.

These investments typically offer regular interest payments and varying levels of safety.

Money market accounts and funds are generally considered safe and provide easy access to funds. Treasury securities are backed by the government and are considered ultra-safe.

Series I savings bonds also offer government backing and can provide higher yields.

Corporate and municipal bonds offer higher interest rates, but investors should carefully assess the creditworthiness of the issuers.

It is important for investors to carefully evaluate their risk tolerance, financial goals, and investment horizon before choosing the right combination of investment options for their $100,000.

Table: Comparison of Investment Options for $100,000

| Investment Option | Risk Level | Potential Return | Liquidity |

|---|---|---|---|

| Stocks | High | High | Variable |

| Real Estate | Medium to High | Medium to High | Medium |

| Commodities | High | High | Variable |

| Collectibles | High | High | Variable |

| Money Market Accounts | Low | Low | High |

| Certificates of Deposit | Low | Low to Medium | Medium |

| Treasury Securities | Low | Low to Medium | High |

| Series I Savings Bonds | Low | Medium | Medium |

| Corporate Bonds | Medium | Medium to High | Medium |

| Municipal Bonds | Medium | Medium to High | Medium |

Interest Rates on Different Savings Accounts

When it comes to choosing the right savings account for your $100,000 investment, understanding the various interest rates available is essential.

Different types of savings accounts offer different rates, which can significantly impact your overall returns.

Let’s take a closer look at the key factors affecting interest rates on savings accounts.

The Importance of High-Yield Savings Accounts

One option to consider is a high-yield savings account.

These accounts typically offer higher interest rates compared to traditional savings accounts offered by brick-and-mortar banks.

With an interest rate of approximately 4.85% Annual Percentage Yield (APY), high-yield savings accounts can help grow your savings faster and increase your overall returns.

National Average Savings Account Rates

It’s also important to understand the national average savings account rates.

Currently, the average APY for savings accounts is around 0.58%.

This means that if you choose a savings account with a rate lower than the national average, your returns may be significantly lower compared to other options.

Therefore, it’s essential to compare the interest rates offered by different banks to ensure you’re getting the best possible return on your $100,000 investment.

Brick-and-Mortar Banks and Savings Account Rates

Brick-and-mortar banks often offer lower interest rates on savings accounts compared to online and high-yield savings accounts.

Some traditional banks may provide rates as low as 0.01% APY. While brick-and-mortar banks offer the advantage of physical locations and familiar names, their lower interest rates can limit the growth potential of your $100,000 investment.

This is why it’s important to explore other options, such as online banks and high-yield savings accounts, to maximize your returns.

| Interest Rate | APY | |

|---|---|---|

| High-Yield Savings Account | 4.85% | 4.85% |

| National Average Savings Account | 0.58% | 0.58% |

| Brick-and-Mortar Bank Savings Account | 0.01% | 0.01% |

By comparing and choosing the right savings account, you can make the most of your $100,000 investment.

Consider the different interest rates offered by high-yield savings accounts, national averages, and traditional brick-and-mortar banks.

Maximizing your returns is all about finding the best savings account with the highest interest rate.

Total Interest and Monthly Payments on a $100,000 Mortgage

When considering a $100,000 mortgage, it is important to understand the total costs involved, including the interest paid and the monthly payments.

Several factors contribute to the overall expenses, such as the interest rate, loan term, and additional costs like escrow.

To calculate the monthly payments, one must consider the principal amount and the interest rate.

Assuming a mortgage with an annual percentage rate (APR) of 6%, the monthly payments for a 30-year term would amount to approximately $843.86.

For a shorter loan term of 15 years, the monthly payments would be around $599.55.

It is crucial to note that the total interest paid over the life of the loan will vary depending on the interest rate and loan term chosen.

With a 6% APR, the total interest paid on a $100,000 mortgage can range from approximately $51,894.23 to $115,838.19.

Monthly Payments and Total Interest Paid on a $100,000 Mortgage

| Loan Term | Interest Rate (APR) | Monthly Payments | Total Interest Paid |

|---|---|---|---|

| 30 years | 6% | $843.86 | $115,838.19 |

| 15 years | 6% | $599.55 | $51,894.23 |

Understanding the costs associated with a $100,000 mortgage is essential for making informed financial decisions. By considering factors like the loan term, interest rate, and total interest paid, borrowers can assess their ability to comfortably manage the monthly payments and plan for the long term.

Where to Get a $100,000 Mortgage

When seeking a $100,000 mortgage, it is essential to consider different mortgage lenders and compare their offers. This allows borrowers to find the best terms and interest rates that align with their financial goals. There are various options for obtaining a mortgage, including traditional brick-and-mortar banks and online lenders.

One useful platform for comparing mortgage options is Credible. Credible provides a convenient way to compare loan estimates from multiple lenders, allowing borrowers to easily assess interest rates, fees, and cash-to-close requirements. By utilizing this online platform, borrowers can save time and effort in their search for the best mortgage deal.

Additionally, online banks have become increasingly popular options for mortgages. These lenders often offer competitive interest rates and reduced fees compared to traditional banks. It is important to carefully review the terms and conditions of online lenders to ensure their legitimacy and reliability.

Mortgage Lenders Comparison

| Lender | Interest Rate | Fees | Cash-to-Close |

|---|---|---|---|

| ABC Bank | 3.5% | $1,500 | $10,000 |

| XYZ Mortgage | 3.2% | $1,000 | $12,000 |

| Online Mortgage | 3.8% | $500 | $8,000 |

As seen in the table above, different mortgage lenders offer varying interest rates, fees, and cash-to-close requirements. Choosing the right lender depends on the borrower’s individual financial situation and preferences. It is recommended to carefully review and compare multiple offers to ensure the best possible terms for a $100,000 mortgage.

Considerations Before Applying for a $100,000 Mortgage

Before applying for a $100,000 mortgage, there are several important considerations to keep in mind. First and foremost, it is crucial to review your credit report and ensure that your credit score is in good shape. Lenders heavily rely on credit scores when evaluating mortgage applications, so addressing any negative marks or errors on your credit report is essential. This can help improve your chances of getting approved and securing favorable terms.

Obtaining a pre-approval letter is another important step in the homebuying process. This letter provides a more accurate estimate of how much you can borrow and demonstrates to sellers that you are a serious buyer. To obtain a pre-approval, you will need to provide documentation such as income statements, bank statements, and tax returns. It’s important to prepare these documents in advance to expedite the pre-approval process.

When preparing for a mortgage, it’s crucial to consider all the details of your home purchase. This includes not just the purchase price, but also closing costs, which can add up to a significant amount. Closing costs typically include fees for appraisals, inspections, title insurance, and attorney services. It’s important to factor in these costs when determining how much you can afford to borrow.

Table: Overview of Considerations Before Applying for a $100,000 Mortgage

| Consideration | Description |

|---|---|

| Credit Report and Score | Review your credit report and address any negative marks. Aim for a good credit score to increase your chances of approval and favorable terms. |

| Pre-Approval | Obtain a pre-approval letter from a lender to determine how much you can borrow and show sellers that you are a serious buyer. |

| Home Purchase Details | Consider the purchase price of the home, as well as closing costs, which can include fees for appraisals, inspections, title insurance, and attorney services. |

| Homeowners Insurance | Factor in the cost of homeowners insurance when determining your budget. This insurance provides protection for your investment. |

Closing costs and homeowners insurance are additional expenses that should be accounted for when calculating the total cost of homeownership. It is important to budget accordingly and ensure that you have enough savings to cover these costs.

By considering these factors before applying for a $100,000 mortgage, you can be better prepared for the homebuying process and increase your chances of a successful mortgage application.

Total Interest Paid and Amortization Schedule on a $100,000 Mortgage

When taking out a $100,000 mortgage, it is crucial to understand the total interest that will be paid over the life of the loan. This information can help borrowers make informed decisions about their finances and plan for the future. Additionally, an amortization schedule provides a detailed breakdown of the costs associated with the mortgage, showing how much is paid towards principal and interest over time.

Understanding Total Interest Paid

The total interest paid on a $100,000 mortgage is influenced by two primary factors: the interest rate and the loan term. Higher interest rates will result in more interest paid over the life of the loan, while longer loan terms will also increase the total interest paid. Conversely, lower interest rates and shorter loan terms can help borrowers reduce the amount of interest they pay.

Amortization Schedule: A Closer Look

An amortization schedule provides a comprehensive overview of the mortgage payments throughout the loan term. It breaks down each payment, showing the amount applied to principal, the amount applied to interest, and the remaining balance. This schedule allows borrowers to see how much equity they are building over time and how their payments contribute to paying off the loan.

“The amortization schedule is a valuable tool that allows borrowers to visualize the progression of their mortgage payments. By analyzing the schedule, borrowers can gain a better understanding of how their payments are allocated and make more informed decisions about their financial goals.”

For example, let’s consider a $100,000 mortgage with a 6% interest rate and a 30-year term.

According to the amortization schedule, the total interest paid over the life of the loan would amount to approximately $115,838.19.

This means that the borrower would end up paying more than the original loan amount in interest alone.

However, by making additional principal payments or opting for a shorter loan term, borrowers can reduce the total interest paid and potentially save thousands of dollars.

| Loan Term | Total Interest Paid |

|---|---|

| 30 years | $115,838.19 |

| 15 years | $51,894.23 |

In conclusion, understanding the total interest paid and reviewing the amortization schedule can provide valuable insights for borrowers. By analyzing these factors, individuals can make informed decisions about their mortgages, potentially save money, and work towards achieving their financial goals.

Conclusion – Monthly Interest on $100,000

When it comes to maximizing returns on $100,000, making smart financial decisions is essential. Whether you’re looking to invest or save, considering factors such as interest rates, safety, and liquidity will help you make informed choices.

By carefully analyzing potential returns and costs, you can choose the right investment or savings vehicle that aligns with your long-term financial goals. Whether it’s opting for interest-earning investments or exploring mortgage options, taking the time to shop around and compare offerings can make a significant difference.

Remember, it’s important to think about the monthly interest on $100,000 and how it can work in your favor. By staying proactive and well-informed, you can make the most of your money and set yourself up for financial success.

FAQ – Monthly Interest on $100,000

How can I calculate the monthly interest on $100,000?

The monthly interest on $100,000 depends on the interest rate. To calculate the monthly interest, divide the interest rate by 12 and multiply it by the principal amount ($100,000). For example, if the interest rate is 5%, the monthly interest would be $416.67.

What are some investment options for $100,000?

There are several investment options for $100,000, including stocks, real estate, commodities, collectibles, money market accounts, money market funds, certificates of deposit, Treasury securities, Series I savings bonds, corporate bonds, and municipal bonds. Each option has its own level of risk and potential return.

What are the interest rates on different savings accounts?

The interest rates on different savings accounts can vary widely. High-yield savings accounts typically offer the highest interest rates, approximately 4.85% APY. The national average for savings account rates is currently around 0.58% APY. Brick-and-mortar banks often offer lower rates, as low as 0.01% APY.

How much are the monthly payments and total interest on a $100,000 mortgage?

The monthly payments and total interest on a $100,000 mortgage depend on factors such as the interest rate, loan term, and additional costs like escrow. Assuming principal and interest only, a mortgage with an APR of 6% would result in monthly payments of approximately $843.86 for a 30-year term and $599.55 for a 15-year term. The total interest paid over the life of the loan can vary based on these factors.

Where can I get a $100,000 mortgage?

To get a $100,000 mortgage, you can reach out to individual lenders or use online platforms like Credible to compare options. It is important to consider factors such as interest rates, fees, and cash-to-close when choosing a mortgage lender.

What should I consider before applying for a $100,000 mortgage?

Before applying for a $100,000 mortgage, it is important to review your credit report and address any negative marks that could affect your ability to get approved. Obtaining a pre-approval letter can provide more confidence in the homebuying process and help determine how much you can borrow. Consider factors such as closing costs, down payment requirements, and necessary homeowners insurance when preparing for a mortgage.

How much total interest will I pay on a $100,000 mortgage?

The total interest paid on a $100,000 mortgage will depend on factors such as the interest rate and loan term. For a mortgage with a 6% APR, the total interest paid can range from approximately $51,894.23 to $115,838.19, depending on the loan term. An amortization schedule provides a breakdown of the costs year by year, showing how much is paid towards principal and interest over time.

What should I consider when choosing investments or a mortgage for $100,000?

When choosing investments or a mortgage for $100,000, it is important to consider factors such as interest rates, safety, liquidity, and long-term financial goals. Analyzing potential returns and costs, comparing options, and making informed decisions can help maximize returns and make smart financial choices.